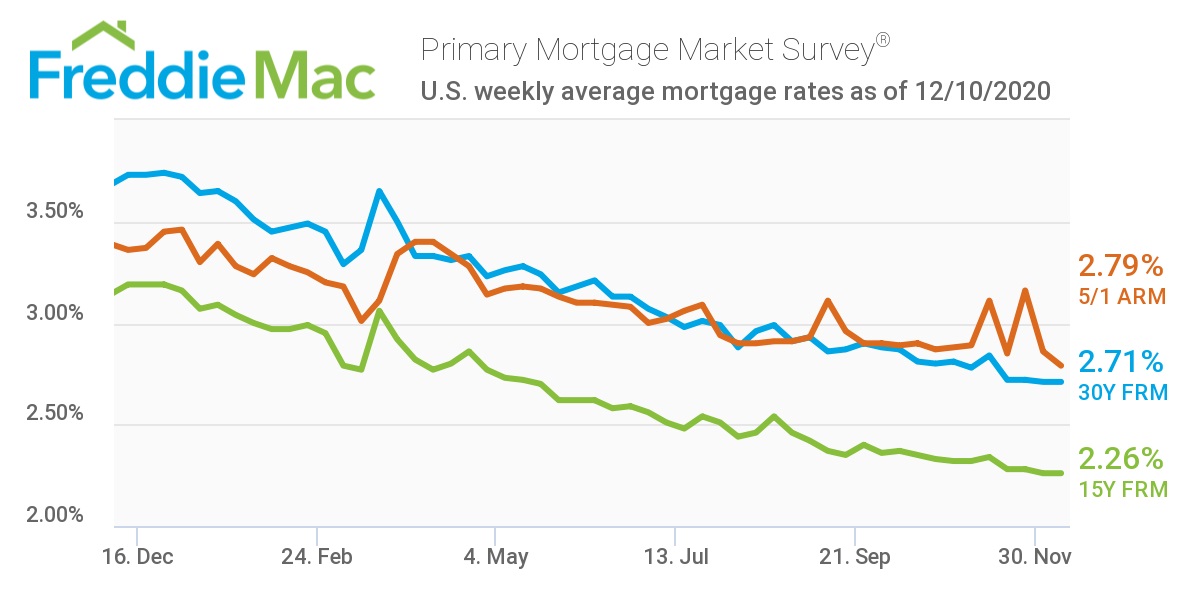

So a 5/1 ARM readjusts the price after 5 years and after that yearly afterwards. As the economic situation recuperates and the Federal Book revealed its strategy to downsize its low-rate policies the most likely outcome will be climbing home loan prices. Nevertheless, the expectation amongst professionals isn't for escalating prices overnight, but instead a gradual rise gradually. Private mortgage insurance coverage and receive far better rate of interest. Purchasing MBS and treasury bonds, as well as this enhanced demand has caused the lowest home mortgage rates on document.

- This will differ depending on your credit score-- far better ratings have a tendency to improve home mortgage prices.

- The cost a customer pays to a lender for borrowing funds over a period of time revealed as a portion price of the loan quantity.

- This indicates it's not an excellent suggestion to handle more debt, unless you minimize your current balance or pay most of them off.

- The cost may consist of refining the application, underwriting and moneying the financing along with other administrative services.

- The table below brings together an extensive national study of home loan lending institutions to help you know what are the most affordable FHA refinance rates.

- For instance, fixed-rate home loans often tend to be greater than adjustable-rate ones.

Browse through our frequent homebuyer concerns to find out the ins as well as outs of this federal government backed financing program. Cash to cover closing costs, which can be anywhere from 2-- 6% of the purchase price. All FHA financing have PMI for the life of the mortgage which is shown in the APR. 30-day lock period.

Lender usually require mortgage insurance policy on conventional fundings with much less than 20% deposit or much less than 20% equity. Your lending term indicates for how long you have to settle the funding. Shorter term loans often tend to have lower rate of interest, but higher monthly settlements. Exactly just how much reduced your rate of interest as well as how much higher the monthly repayment will certainly depend a great deal on the particular financing term and also rate of interest type you choose. Since home mortgage prices are so specific to the borrower, the very best method to discover the prices readily available to you is to obtain quotes from several lending institutions. If you're early in the homebuying process, get prequalificationand/orpreapproval with numerous loan providers to compare as well as contrast what they're using.

This is done with a close evaluation of revenue and regular monthly costs. FHA loans are offered for people with credit rating of 580 or higher as well as deposits as low as 3.5%. Select a product to view important disclosures, settlements, presumptions, as well as APR details. Please note we offer extra mortgage options not shown right here. Home loans feature all kind of various rate of interest as well as terms.

Choose A Finance Kind

Mortgage rates change daily, in some cases even per hour, which is why it's suitable to lock-in the mortgage price when interest rates go to their cheapest. If you are self-employed, you need to show proof of your income for the last two years. It likewise assists to reveal other incomes, such as https://www.trustpilot.com/review/timesharecancellations.com?utm_medium=trustbox&utm_source=Carousel overtime salary, investments, cash from alimony, etc. You should likewise show thorough monetary information such as financial institution declarations, retirement advantages, and pay stubs.

Taken Care Of Price Fha Fundings

With a price lock, your interest rate will not transform for a set quantity of time. If there are hold-ups in shutting your financing and your rate lock will certainly expire before you can complete the re-finance, you might be able to get an extension. If that occurs, make certain to ask if there are fees for prolonging the price lock. FHA home loan insurance shields lenders in cases where the property owner defaults on the funding.

Finding the very best house mortgage rate refers knowing your objectives and selecting the best device to finish the job. The very best home loan for you might not constantly be the one with the lowest interest rate. Variables like for how long you keep your home mortgage will affect your choice. Despite having the zig-zag pattern, professionals still anticipate prices to enhance incrementally with 2022 as the economy recovers.

Federal Government Car Loans

FHA finances bill a required home loan insurance premium, which is made use of by the FHA to money the mortgage program. It is called for whether or not you make a 20% deposit on your residential or commercial property. Note that this sort of home mortgage insurance coverage just safeguards the lender. It's is an added cost which does nothing for you in situation you have trouble making car loan repayments.

Neither FHALoans.com nor MRC are recommended by, sponsored by or connected with the Dept. of Housing as well as Urban Advancement or any type of other government firm. MRC gets settlement for giving advertising solutions to a choose group of business associated with aiding consumers find, get or re-finance homes. If you submit your details on this How Do Timeshares Work site, several of these business will certainly call you with extra info concerning your demand. By submitting your information you agree MRC can offer your information to among these business, that will certainly after that contact you.

The amount of residence you can manage depends on more than just your income and also financial debt. The ordinary rates of interest on a 5/1 ARM sits at 2.74%, greater than the 52-week low of 2.83%. Normally, the higher your deposit, the lower your rate might be. House owners who put down at the very least 20 percent will have the ability to save the most.